I know crowdfunding is a bit of the technological soup du jour right now and for good reason – it’s disrupting many different industries and challenging the fundamentals of investment capital and securities regulation.

I believe all these things are good for the future of technology and innovation and I’m happy to have experienced it (or I’m in the middle of experiencing it) first-hand. But because I live in a WordPress world I instantly think about crowdfunding the applications and implications for our ecosystem.

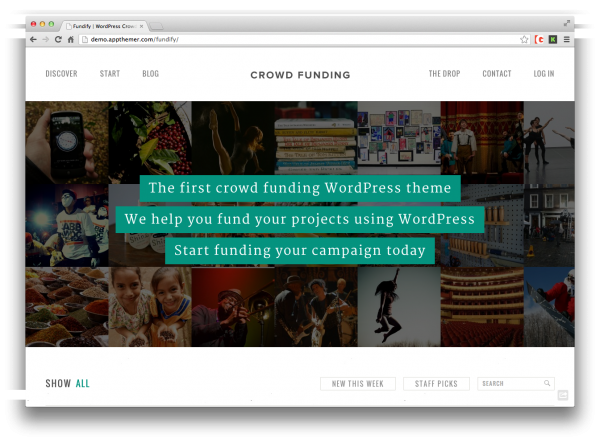

For example, with standalone themes like Fundify and their accompanying crowdfunding plugin it makes me wonder if giving crowdfunding power to anyone and everyone is really a good and smart thing.

You see, for those that aren’t keeping track, earlier last year the House of Representatives passed the HR 3606 to make the necessary changes to our security laws by allowing companies that seek crowdfunding sources to legally solicit investors. The equivalent bill in the Senate, SB 1933 was recently passed as well which is a huge win.

This Crowdfunding Act lowers the barrier of investment in companies that haven’t gone public (sub $1B) and could help the next Google, Facebook, or Twitter to emerge through licensed brokers or accredited portals and services.

But the biggest issue on the floor was the potential for rampant fraud – you see, if everyone could create a crowdfunding site and start soliciting funds for projects then it could create a lot of freedom to head-fake consumers and users to sending money for bogus projects. The result was bigger and better protections and oversight.

But how do you create protections and oversight into an open source community that can literally create their own sites at will, hundreds and thousands of times over?

With Kickstarter, Indiegogo, and the like, it’s a “donation” in exchange for a product or a reward of some sort (besides a nice pat on the back). No equity is exchanged and no financial relationship is tied long-term to the project owner/business and the person handing over a pledge of funds.

The passing of the bills allows small companies to go public through scaled investment, much smaller scale that is. Previously, you had to be a licensed investor/broker to do such a thing. This was and is a good thing because selling snake-oil tactics was prevented.

But that’s the issue, or the challenge rather. Now with this bill coupled with off-the-shelf technology like a WordPress theme or free plugin, you have a much larger issue with not just project owners and snake-oil salesman but a much larger caveat emptor economy. It’s dangerous and incredibly volatile to allow startups sell shares without the financial metrics required to potential investors. These restrictions are good for the buyer and investor, for good reason.

This is not just a creation of a regulation – it’s rather a deregulation of sorts. What has happened historically may happen, with the spur of open source and lower-barrier technology (like WordPress themes) where you simply create more intelligent and thoughtful criminals instead of better and smarter consumers and buyers.

All-in-all I see the open source community and even WordPress specifically will come to a head in some form and fashion with regulations and crowdfunding. I think the ending result is going to be a good one although it might be painful.

I’m incredibly thankful for this new world economy and glad to be a part of it, but I’m not naive to see that with disruption comes, well, disruption; it’s not always pleasant. Perhaps I’m one of a very select few who deeply care about this new funding and technological economy; perhaps I’ve give it way too much thought.

3 Comments

Join the conversation