At some point, your business might outgrow PayPal. You may even be there already. While PayPal is perfectly adequate for part-time WordPress developers, or those who are just starting out. But if you’re serious about your business, it pays to investigate more full-featured solutions that will help you whip your business finances into shape. Solid billing/invoicing systems help improve your business’s cash flow, put more money in your wallet, and achieve your financial goals. We have five finance apps that are perfect for your business.

As Erika Napoletano says, “Smart small businesses know that they need a billing, invoicing, and payment system that shows the true history and future of a business.”

Below, you’ll find five strong contenders that fit the bill — and we’re betting one of them will work for your business.

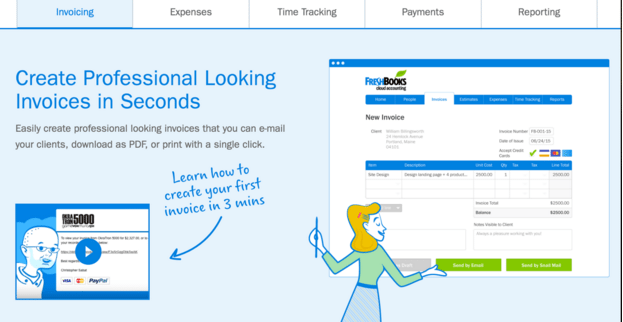

Freshbooks

Freshbooks is probably the most well-known full-featured finance app for small business owners. It offers invoicing, time tracking, and payment processing. Freshbooks even lets you connect your accountant with your data, so tax filings are easier.

In fact, it’s so well-featured that it might intimidate some, although it offers both online/text-based and live support. Another downside to Freshbooks is that it only allows the addition of a single team member, and that’s only at the priciest account level.

Freshbooks offers four different paid plans at varying price points ($12.95 to $39.95 per month). The entry level account only allows for invoicing up to 5 clients; you’ll probably get more mileage out of the Seedling plan at $19.95/month, which increases that to 20 clients.

There’s no free plan, but you can try it out at no cost for 30 days.

Harvest

Harvest may not be as well-known as Freshbooks, but it has some pretty ecstatic users who sing its praises. It’s a robust multi-function solution, with features including invoicing, time-tracking (with mobile apps for both Android and iOS), budget setting and tracking for projects, and easy expense logging.

The system also integrates with over 80 popular apps that are familiar to entrepreneurs and small business owners. Everything from productivity and task management apps, such as Asana and Trello, to customer support apps like Zendesk and more.

Harvest offers four account levels, all with unlimited invoices each month. Free accounts get one user, up to 4 clients, and 2 projects each month. The Solo account offers unlimited clients and projects for $12 per month.

Bigger businesses will find more value in the Basic ($49/month) or Business ($99/month) accounts, which also provide a timesheet-approval function.

And if you need to add users, Harvest lets you do that for a straight $10 per user per month.

Harvest also offers a free 30 day trial that’s fully-featured, so you can give it a thorough assessment.

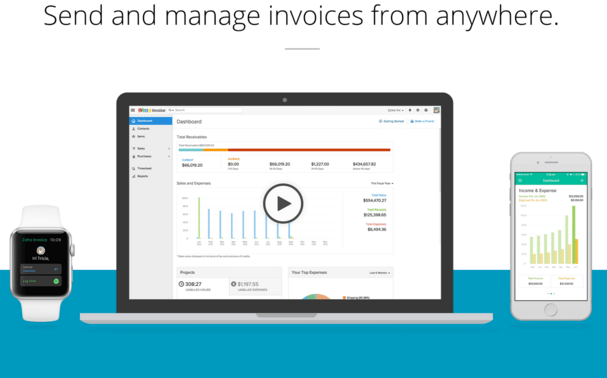

Zoho

When it comes to small business software, Zoho is a behemoth. It offers a dizzying array of tools, but

Zoho Invoice offers four accounts at price points ranging from free to $30 a month. The free account can create invoices for up to 25 customers each month.

Their most popular account, the Standard level at $15/month, covers up to 500 customers and up to 3 team members, making it a workable solution for larger businesses with contractors or employees. And you can get 2 months free if you pay for a full year at a time.

Zoho offers extensive functionality, including timesheets and time tracking, expense logging, and snail mail invoices (should you have a need for that).

And at every level, you’ll get access to customizable invoice templates that you can change to reflect your brand.

Servicejoy

Servicejoy may not be as familiar as some of the other names on our list, but it was built specifically for service professionals like WordPress developers.

You can personalize your invoices with emoticons, images and more, and send them as individual one-time invoices, or you can establish a recurring schedule and Servicejoy will send them out automatically.

You can also use Servicejoy to prepare and send estimates, manage your tasks and projects, and manage client accounts. And if you run into trouble, Servicejoy offers free 24/7 support.

The pricing plan is a bit different from our other favorite finance apps on this list. There’s a free account, which allows 5 active clients and up to 500 MB of space for related files. There are also two paid accounts — Pro at $20/month and Business at $30/month — that support more clients and file storage.

You can also try before you commit, with a 45-day free trial.

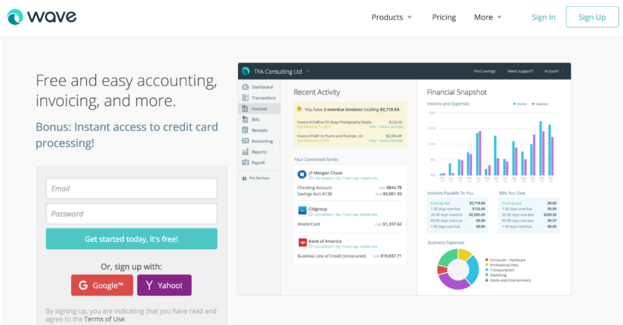

Wave

When they say free, they mean it. Wave has exactly one account level, and it’s free.

That does mean that Wave is supported by advertising, but this app sacrifices nothing in the way of the kind of functionality WordPress developers need. It handles accounting, invoicing, and receipt scanning.

And if your business needs more, Wave can still help, through premium add-on services that can help you process payments, manage payroll, and more.

Conclusion

If you’re serious about your business, it’s time to get equally serious about your business finances. And in that regard, PayPal isn’t necessarily the answer to all your financial challenges.

All that said, however, there’s absolutely a place for PayPal in your overall financial systems. Online payment gateways eliminate excuses and delays that accompany snail-mail payment by check. But if you’re ready to grow your business, not to mention your bottom line, pick one of these solutions and create a smart financial system that works for you.

Did we mention your favorite financial app in our list? If not, let us know in the comments section below!

No Comments

Start the conversation